Alternative payment methods (APMs), also called local or additional payment methods, are popular means of payment that do not require a shopper to use a major credit card scheme, such as Visa or Mastercard. Many regions around the world prefer to check out with their local APMs rather than entering credit card information, so adding them to your store’s checkout helps you reach a global audience and improve international conversions.

APMs range from digital wallets available around the world, such as Apple Pay and Google Pay, to region-specific payment options like iDEAL in the Netherlands or SEPA in the European Union. Just as seeing PayPal on checkout can help American consumers feel more comfortable about a purchase, seeing these offerings can make your customers feel more comfortable with purchasing from your store.

In contrast with traditional payment methods, APMs are typically offered through a cooperating payment gateway. For example, ACH Direct Debit is enabled through Adyen or BlueSnap Direct as opposed to a standalone integration.

In this guide, we will cover the benefits of offering APMs at checkout, explain the different types of APMs, and provide a breakdown of requirements, supported gateways, features, and limitations for each APM available in BigCommerce.

What are the Benefits of APMs?

Convenience

Alternative payment methods have become popular because they provide a direct, hassle-free option for shoppers who prefer not to use traditional forms of online payment.For example, digital wallets and mobile payment options streamline the checkout process for shoppers, or allow them to bypass checkout entirely by auto-filling their credentials and billing information.

By enabling APMs alongside your existing payment gateways, you enhance the variety of options and ease-of-use of your store’s customer experience.

Selling Internationally

APMs are a valuable tool when selling your products outside the US. The popularity of payment gateways differs greatly by region and country, and many shoppers expect to see region-specific payment options at checkout.

Once enabled, local payment methods have country and currency prerequisites that ensure shoppers will see only the local payment methods applicable for their geolocation. Including region-specific APMs that shoppers both recognize and trust will help you expand your global customer base.

Types of Alternative Payment Methods

“Alternative payment methods” is a blanket term that covers a variety of payment methods. Each APM can be classified as one of the following types, each with its own distinct advantages:

- Bank transfers — Bank transfer APMs allow shoppers to complete transactions from a bank account instead of entering in credit card details. An example of bank transfer APMs include Open Banking and iDEAL.

- Direct debit — Direct debit APMs pull funds directly from the shopper’s bank account, similar to bank transfers. These are popular for recurring or subscription-based payments. Examples of direct debit APMs include ACH and SEPA.

- Cash payment — When a shopper uses a cash payment method to place an order, they receive a payment slip or voucher to present to a participating retail location. From there, the shopper completes the transaction in cash and the merchant is notified of the successful payment. Examples of cash payment APMs include Boleto Bancário and Fawry.

- Digital wallets — A digital wallet allows shoppers to load and store funds on a third-party account. They can then complete transactions quickly, without having to enter payment information or create a separate account on the checkout. Examples of digital wallet APMs include Alipay and Venmo.

- Mobile payments — Mobile payment APMs use credit card and address information saved on your mobile device to complete transactions with the tap of a button. Examples of mobile payment APMs include Apple Pay and Google Pay.

- Delayed/installment payments — These APMs enable shoppers to ‘Buy Now and Pay Later’ in a single payment or a series of scheduled installments. Examples of delayed payment APMs include Klarna and PayPal Pay Later.

APM Order Flow

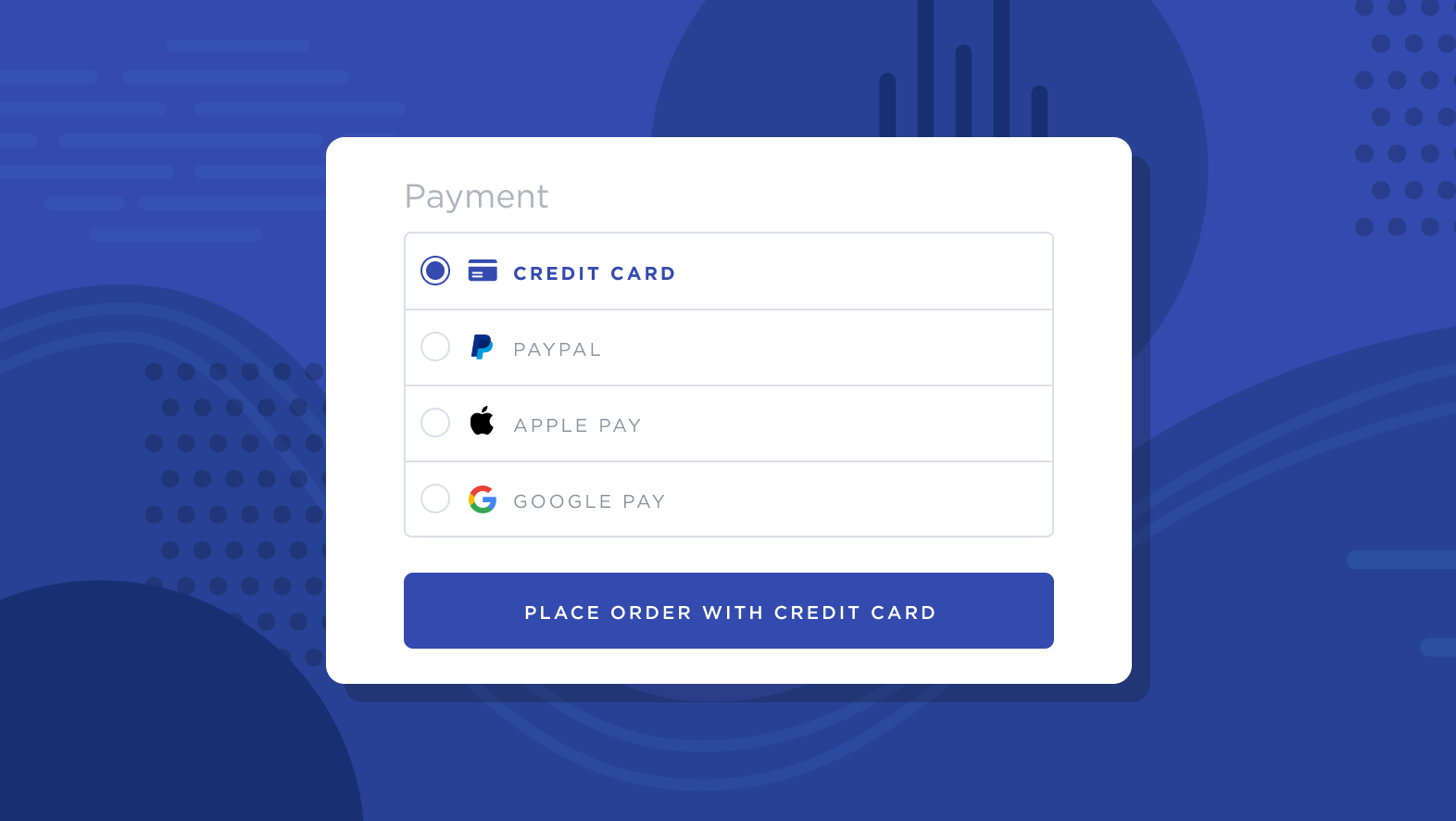

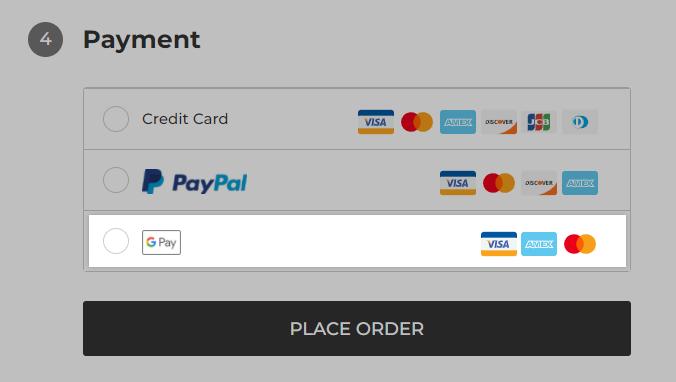

Once you’ve enabled an alternative payment method in your store, your shoppers will see them listed with your other payment options at checkout. Unlike most payment gateways, an APM's display name on the checkout page cannot be customized.

Some digital wallets and mobile payment options bypass the checkout by appearing as buttons on your cart page and quick cart modal.

When using an APM during checkout, shoppers will be redirected to the payment method to finalize their payment, then redirected back to the store once checkout is completed. This gives shoppers a unified experience, and ensures that they see any important information on your order confirmation page.

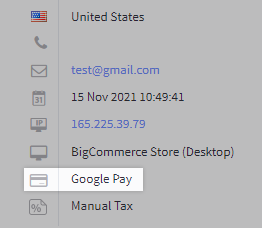

Orders placed using an APM can be identified in Orders › View by looking in the Payment Method field in the order’s details.

APM orders share the same fulfillment process as other orders. However, features such as delayed capture or in-control panel refunds may not be supported.