Adyen is a leading payments technology company focused on rapidly expanding businesses in the global economy. Adyen gives you access to a global all-in-one payments platform that accepts all major global and local payment methods, and allows you to expand quickly into new markets and sales channels, while assisting you in managing risks and tracking your results.

Adyen can help any merchant looking to expand internationally. Merchants who have multiple stores, each serving individual countries, can benefit the most. For example, a store serving Japan with Yen as the transactional currency can offer country-specific payment methods and international payment methods (that support Yen) to local and international shoppers respectively.

Additionally, European merchants who want to support regional shoppers with their local currency and payment methods can leverage the benefits of Adyen. For example, on your German online store, with Euro as the transactional currency, you can allow EU shoppers to make payments in Euro using their local payment method.

Look different? We are currently rolling out improvements to onboarding to Adyen and available settings and features. This article has been updated to show the most current version. If your control panel shows a different version, feel free to reach out to our Community or contact our Support team for assistance.

Requirements

To use Adyen, your store must meet the following requirements:

- You must have an active Adyen merchant account. If you do not currently have one, contact Adyen to create an account. Your account will need to be approved before proceeding with setup.

- Your store must meet the Account Eligibility requirements for country, currency, and products.

- Manage Payments and Manage Settings user permissions must be enabled.

Setting up Adyen

Once your merchant account is approved, Adyen will provide you with merchant credentials. Use the steps below to connect your merchant account with your store.

Using Bolt with Adyen? To avoid duplicate fields, the built-in credit card feature is automatically disabled and replaced by Bolt's hosted credit card fields when you select Adyen as the payment processor on your Bolt account. Credit card fields can be manually enabled if desired from Adyen Settings in the BigCommerce control panel. Other Adyen payment methods, such as APMs, will remain visible on the checkout.

Go to Settings › Payments and click on Online Payment Methods, then click the Set up button next to Adyen.

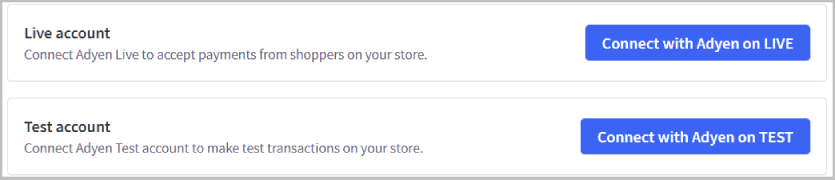

Select the type of Adyen account connection that you would like to set up by clicking one of the following buttons:

- Connect with Adyen on LIVE — Use Adyen to accept live payments from shoppers on your store.

- Connect with Adyen on TEST — Use Adyen to make test transactions on your store.

Connected with Adyen to test payments? When you are ready to take payments from shoppers, you will need to reconnect with Adyen as a live connection to successfully process transactions.

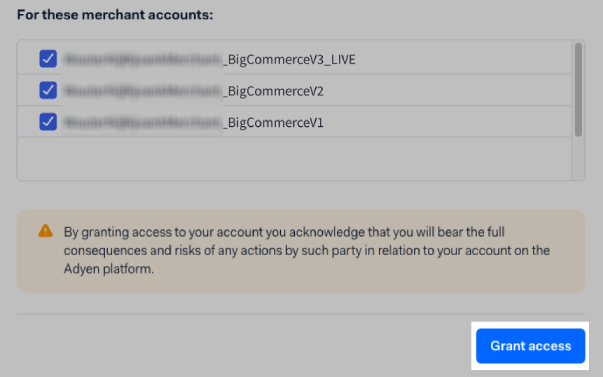

You will be asked to log in to the Adyen customer area, and then prompted to allow BigCommerce to connect to your Adyen account to process transactions.

Select the merchant account that you would like to connect to your BigCommerce store. If you have multiple merchant accounts, you may select more than one. Use cases for connecting multiple merchant accounts include multicurrency, where each merchant account uses a different currency.

When you are ready, click Grant access.

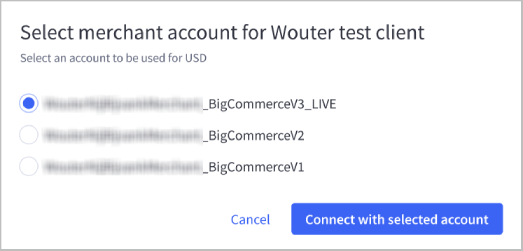

You will be redirected back to the BigCommerce control panel, and prompted to select the merchant account to be used with the selected currency.

Click Connect with selected account to finish setup and start accepting payments immediately using this merchant account.

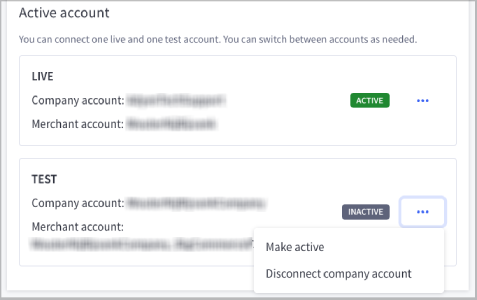

You can connect to an Adyen merchant account on Adyen’s Test and Live platform at the same time, and manage which connection is active on your store. Once you have set up your initial account, go to Adyen Settings and click Connect with Adyen on LIVE or Connect with Adyen on TEST. Follow the steps above to complete set up. Once the second connection is added, click on the Action menu beside the inactive account and select Make active to switch from the Test platform to Live, and vice versa.

Accounts

The Active account area lists the information associated with connected live and test accounts, along with connection status. Click on the Action menu to view the following settings:

- Switch merchant account — quickly switch between the merchant accounts previously added during setup

- View integration parameters — review account connection information

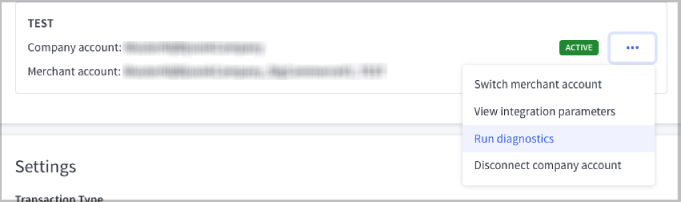

- Run diagnostics — check and confirm that Adyen is working correctly, with valid parameters

- Disconnect company account — disconnect your company account

Diagnostics

To check the connection between your BigCommerce store and your Adyen merchant account, click on the … button and select Run Diagnostics.

The diagnostics tool will check with Adyen to see if the following parameters are valid and working correctly:

- Capture mode

- Webhook configuration

- Allowed origins

- Live prefix API endpoint values

- Checkout API operations

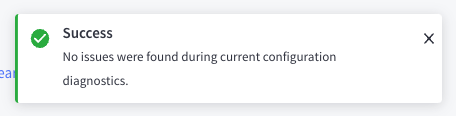

If the diagnostics tool returns with no errors, you will receive a successful confirmation message.

If an issue is detected, then you will receive an error message detailing the issue. We recommend always trying to reconnect your Adyen merchant account as the first step towards resolving any detected issues.

Additional Settings

While your active account settings are only viewable after adding new accounts, there are several feature settings that can be configured from the Adyen Settings tab in the control panel.

- Transaction type — Select "Authorize and Capture" (recommended) or "Authorize Only." See Manually Capturing Transactions for details.

- Credit Card — Enable credit card payments at checkout and auto-populate the cardholder’s name from the billing address.

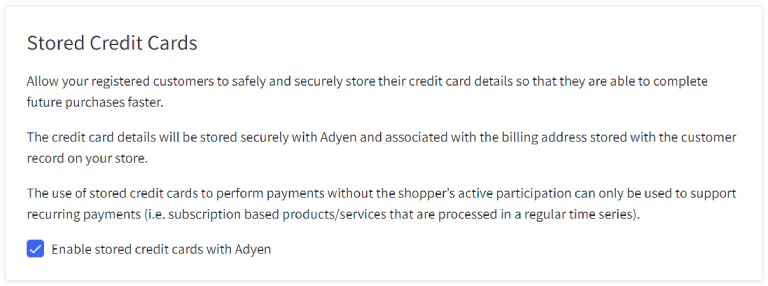

- Stored credit cards — Click the checkbox to enable stored credit cards with Adyen. You will need to take additional steps in your Adyen customer area to complete the setup of this feature.

- Google Pay — Click the checkbox to offer Google Pay as a payment method.

- Manual Orders — Click the checkbox to enable Adyen as a payment method for manual orders in your store. You will need to enable this setting in your Adyen Customer Area as well.

Stored Credit Cards

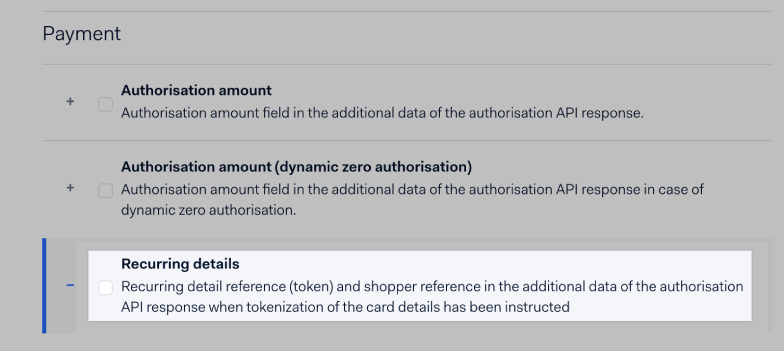

To enable Stored Credit Cards for your Adyen account, log into your Adyen customer area, then go to Account › API URLs › Additional data settings.

Enable the Recurring details data field, then save your Adyen customer area settings.

Once you've saved your settings in Adyen, click the "Enable stored credit card with Adyen" checkbox in the Adyen settings page in your BigCommerce control panel. This will give shoppers the ability to store their credit card information after entering it during checkout.

You can also allow shoppers to store and edit credit card information directly within their storefront customer account. For more information and setup instructions, see our documentation in the Dev Center on Adding Stored Payment Methods.

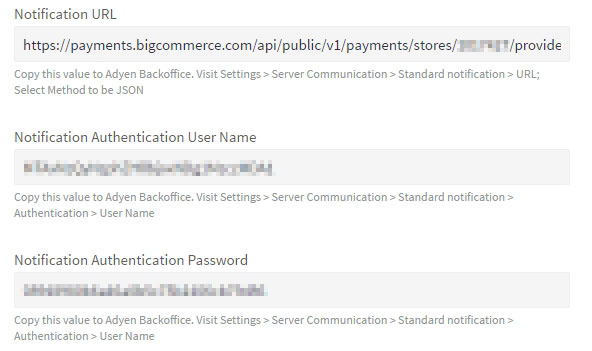

Notification Settings

This feature is only available for merchants onboarded with the previous Adyen v2 experience. These settings are built into the v3 experience automatically and do not need to be manually configured.

When setting up Adyen v2, Standard Notifications must be manually configured in order for basic capabilities to work, such as void, capture, refund, vaulting, and accepting payment with APMs. These settings will be used to configure notifications from Adyen to BigCommerce. Follow the steps in the control panel to fill out these fields in Adyen, then save your changes.

- Notification URL — This value is pre-generated in your store. It needs to be added to Adyen by using the steps below the field.

- Notification Authentication User Name — the username for authentication

- Notification Authentication Password — the password associated with the username

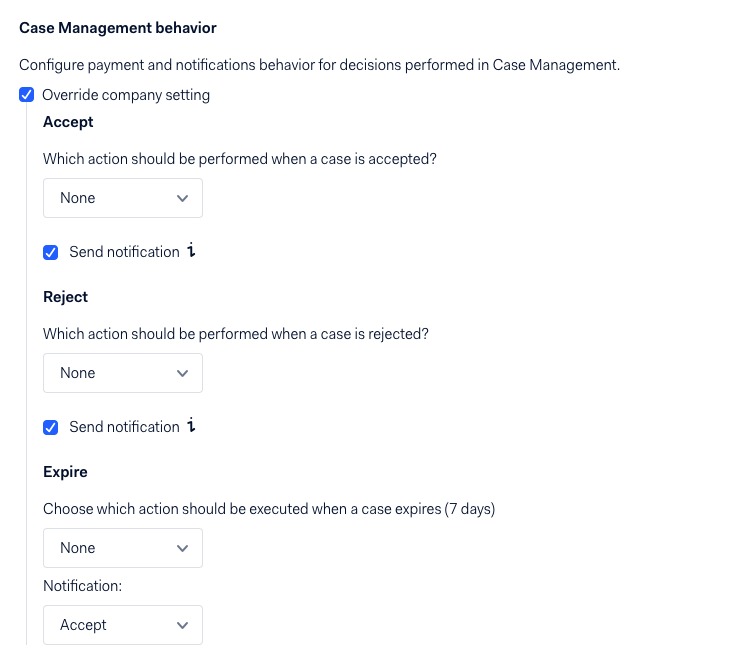

Enabling Manual Review

BigCommerce supports the ability to manually review a transaction before it is captured using Adyen’s Case Management feature. If you have manual review enabled in Adyen and a transaction is flagged, BigCommerce will mark the order as "Manual Verification Required", and you will be required to manually capture the funds.

By approving or rejecting the case from the Adyen dashboard, you can notify BigCommerce of this decision so that the funds are either captured or canceled automatically. This feature is only supported for debit and credit card transactions.

To ensure BigCommerce is notified of decisions made by you in Adyen, follow the steps below to configure the Case Management behavior settings in the Adyen Customer Area.

Using an older Adyen experience? If you are using the Adyen v2 experience, you must have Standard Notifications configured for your store before enabling manual review.

1. In the Adyen customer area, go to Risk › Risk Settings.

2. In the Case Management behavior section, update these settings (see screenshot below):

- Set the Accept action to None and check the box to send notifications.

- Set the Reject action to None and check the box to send notifications.

- Set the Expire action to None and set the notification setting to either Reject or Accept.

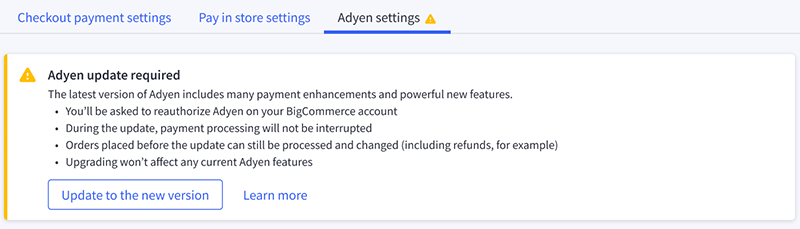

Updating to the Latest Version

We recommend upgrading to the latest version of Adyen to ensure you have access to future enhancements and new Alternative Payment Methods.

Using B2B Edition? Upgrading your Adyen integration will automatically disable the gateway in your default and Company-specific available payment methods. Re-enable Adyen for the desired Company accounts after upgrading to allow your customers to use it at checkout.

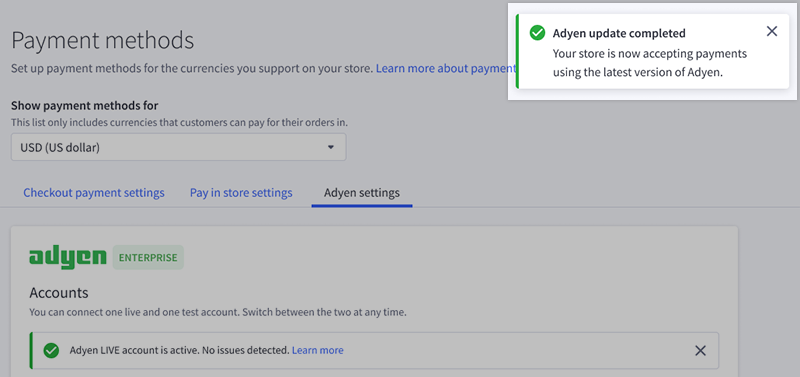

If a newer version of the integration is available, you will see an update notification message on the Adyen settings page.

Click the Update to the new version button to get started.

- You’ll be asked to reauthorize Adyen on your BigCommerce account.

- During the update, payment processing will not be interrupted.

- Orders placed before the update can still be processed and changed. This includes actions such as refunds.

- Upgrading won’t affect any current Adyen features.

After you’ve reauthorized Adyen and selected the Adyen merchant account you want to use with your store, you will see a success message indicating the upgrade was successful. You will need to repeat the update process for each of your transactional currencies.

Important: After you’ve successfully updated to the new version, do not change or remove your BigCommerce store’s API credentials in the Adyen Customer Area for at least 60 days. BigCommerce will use this data to process any changes to orders created with the old version (such as issuing refunds).

Common Questions

This information is for the Adyen integration. For common questions and troubleshooting information about a supported APM, see our Guide to Alternative Payment Methods.

- General

- Pricing and Fees

- Account Eligibility

- Transactions

- Refunds

- Additional Features

- Troubleshooting and Payment Disputes

General

What currencies does BigCommerce's Adyen integration support?

Adyen enables payments from anywhere in the world in over 150 currencies.

What currencies can I settle in?

You can settle in the following currencies:

| EUR | GBP | MXN | SEK |

| AUD | HKD | NOK | SGD |

| CAD | HRK | NZD | THB |

| CHF | HUF | PLN | TRY |

| CZK | ILS | RON | USD |

| DKK | JPY | RUB | ZAR |

What global and local credit/debit cards are supported by BigCommerce's Adyen integration?

See Adyen’s documentation for an overview of supported cards.

Does Adyen support manual orders?

Yes, Adyen can be used to process manual orders (orders created from the control panel). Before you enable this, the PCI role must first be enabled within your Adyen customer area. To request enablement, reach out to Adyen. After enablement, click the Manual Orders checkbox from your Adyen settings.

Pricing and Fees

What fees are associated with Adyen?

For pricing information, see Adyen's price list. You can also give Adyen a call, contact the Adyen sales team directly, or reach out via email.

Account Eligibility

What currencies and countries does BigCommerce's Adyen integration support?

To use this integration, the default country in your Store Profile Settings must be set as one of the following countries.

| Region | Supported Countries | |||

|---|---|---|---|---|

| Americas | United States | Canada | Mexico | Brazil |

| Europe | Austria | Belgium | Bulgaria | Croatia |

| Czech Republic | Denmark | Estonia | Finland | |

| France | Germany | Greece | Hungary | |

| Iceland | Ireland | Italy | Latvia | |

| Liechtenstein | Lithuania | Luxembourg | Monaco | |

| Netherlands | Norway | Poland | Portugal | |

| Romania | Russia | Slovenia | Spain | |

| Sweden | Switzerland | Turkey | United Kingdom | |

| Asia Pacific | Australia | China | Hong Kong | India |

| Indonesia | Japan | Malaysia | New Zealand | |

| Philippines | Singapore | South Korea | Taiwan | |

| Thailand |

What items are restricted for merchants to sell?

See Adyen's Restricted & Prohibited List.

Transactions

After I create an account, what is the waiting period before I can process transactions?

The waiting period depends on two things: compliance checks (which can typically take 1-3 business days) and bank account setup (depends on complexity/number of accounts). Once complete, merchants can process transactions as well as receive the payout funds through their bank accounts.

How long until a transaction's funds are transferred to my bank?

This depends on your location and payout model. To find your payout model, log in to your Adyen customer area, then go to Finance › Payout model. See Adyen's Payment Lifecycle for more information.

When using Adyen v2, why does a payment show as Settled within my Adyen customer area, but shows as Awaiting Payment within BigCommerce?

This can happen when the Capture Delay setting within your Adyen customer area is not set to Manual. This setting must be set to Manual to keep the payment statuses in sync.

If I change the order status in BigCommerce from Awaiting Payment to Cancelled, will that automatically update in Adyen?

No, BigCommerce does not automatically send a request to Adyen to cancel the authorization in this case. You will need to manually cancel the authorization within your Adyen customer area.

Refunds

How soon after a transaction can I perform a refund?

The waiting period will depend on the payment method and transaction type. A sale transaction assumes automatic capture upon authorization, so a refund can be initiated immediately. For authorize/capture, you can cancel a transaction any time until you receive a capture notification. You can send a refund request after a transaction has been captured.

For local payment methods, timing depends on whether or not funds are guaranteed. For example, with direct debit and online banking, a transaction must be settled before a refund can be initiated. Payment methods with guaranteed funds, such as iDEAL, allow for an immediate refund.

How do I perform a refund?

A refund may be submitted through the BigCommerce control panel. See Processing Refunds for more information.

How do I check the status of a refund?

Instructions to check refund status are located on Adyen's refunds and charges page.

Is there an amount of time after which I cannot perform a refund?

Adyen conforms to the rules and regulations of each payment method. As a general rule, Adyen doesn’t limit the refund window but relies on each payment type’s rules to establish those limits.

Are there any fees for chargebacks/refunds?

Yes, there is a fee per chargeback. Refunds are charged the same as regular transactions. Additional costs apply for bank-based refunds, such as Bank Transfers and Direct Debits. This refund commission cost doesn’t apply to credit cards and debit cards. See Adyen's Pricing page for more information.

Additional Features

Are there any fraud filtering options available?

Yes. Adyen allows merchants to take a customized approach based on their specific requirements. See Adyen's Risk management for more information. Adyen's fraud prevention tool requires no extra integration and can be managed from your Adyen account.

Does the Adyen integration include 3DS2.0 and comply with the PSD2 regulation in Europe?

Yes. Whether or not you are enrolled in the 3D Secure program depends on your Adyen MID.

- Merchants in Europe are automatically enrolled.

- Merchants in North America must manually enroll from within your Adyen customer area. To request enrollment, contact Adyen.

See 3D Secure for more information.

Can my business submit Level 2 and Level 3 (L2/L3) data?

Yes. You can submit L2/L3 data if your business is eligible and meets qualification requirements. See Adyen's Level 2/3 ESD for more information.

What Level 2 and Level 3 (L2/L3) data is included in Adyen transactions?

The table below lists what data will be passed in each transaction.

| Purchase Details | Product Details |

| Customer reference | Commodity code |

| Total tax amount | Description |

| Freight amount | Product code |

| Destination postal code | Quantity |

| Destination state/province code | Unit of Measure |

| Destination country code | Unit price |

| Order date | Total amount |

Does the Adyen integration include stored instruments?

Yes, credit/debit cards can be stored with Adyen. See Enabling Stored Payment Methods for more information on this feature. Adyen only stores the credit card number, and never has access to the associated billing address or customer record from your store.

Does the Adyen integration support stored credit/debit card management from customer storefront accounts?

Yes. To allow shoppers to store and edit their credit/debit card information in customer accounts, you will need to install the Storefront account payments microapp to your theme. See our documentation on Adding Stored Payment Methods in the Dev Center for more information and setup instructions.

Are stored credit cards available on the cart page?

No, stored credit cards are only supported from the checkout page.

Which alternative payment methods (APMs) are available with Adyen?

Our Adyen integration supports all of the APMs listed below. You will need to submit a request for the specific APM to be enabled on your Adyen account in your Adyen customer area. For requirements and setup information on a specific APM, see its linked guide chapter:

Are recurring payments supported on Adyen APMs?

No, recurring payments on APMs are not supported.

Does Adyen support Multicurrency?

Yes, Multicurrency is supported in the integration. To learn more about setting up and using this feature on your store, see Using Multiple Currencies.

Troubleshooting and Payment Disputes

Why isn't Adyen showing up on my checkout page?

Use the Diagnostics tool in Adyen Settings to check the connection between your Adyen merchant account and BigCommerce store. If an issue is detected, try reconnecting your Adyen account to resolve the issue before reaching out to our Support team.

If you are using our previous integration (Adyen v2), this can happen if your Adyen credentials are not filled out or are entered incorrectly.

Why am I not receiving order notifications?

When using Adyen v2, this can happen if your Notification Settings are not filled out or if the information has been entered incorrectly.

How are payment disputes handled?

Disputes and chargebacks can be managed through your Adyen account. See Adyen's Disputes for more information. Additionally, this video tutorial from Adyen offers a quick overview on managing disputes.

How do I contact Adyen's Support?

BigCommerce customers can contact Adyen via ticket or by phone.