Klarna is a popular alternative payment method that complements your checkout with Buy Now Pay Later financing and installments, along with the traditional “pay now” option. You can increase Average Order Value (AOV) and conversions by providing convenient, stress-free flexible financing without taking on additional risk.

Klarna pays merchants in full for each transaction, taking over the responsibility for collecting payment from your customers.

This article contains information specific to the Klarna integration available via other payment gateways. To learn about the standalone payment gateway, see Connecting with Klarna Payments.

How It Works

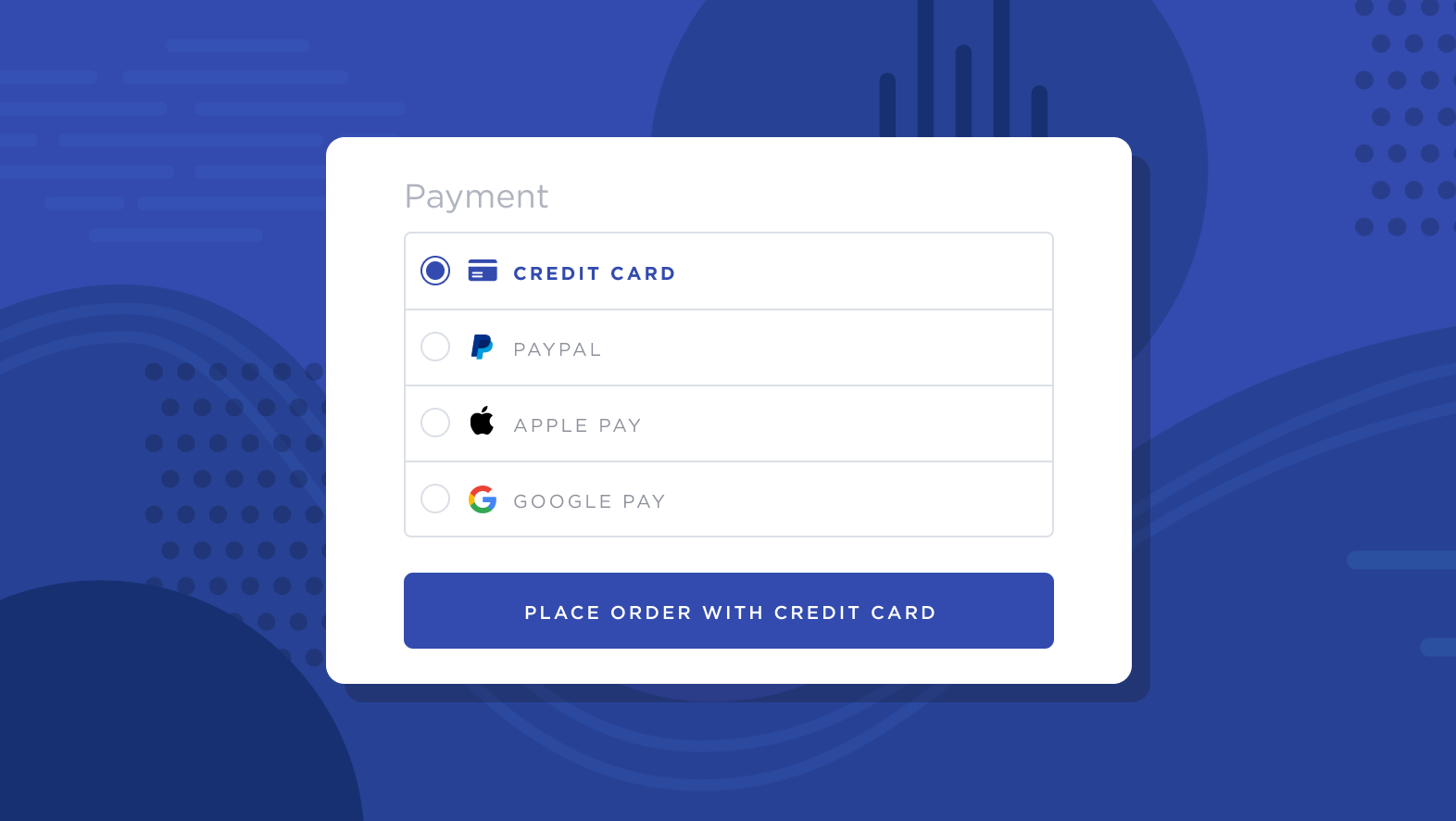

Once you've enabled Klarna, shoppers that meet the requirements will see options to pay for their order now, pay at a later date, or pay in installments.

.png)

Upon selecting their preferred Klarna payment option, the shopper will be redirected to the Klarna payment page to either complete their transaction or view the details of their payment plan.

Shoppers in the UK who are using GBP as their transactional currency will see the option to Pay with Klarna, if you are using the Mollie payment gateway. After choosing this option, the shopper will be redirected to Klarna’s payment page to select the payment method and complete the transaction.

After the order has been placed, it will appear in your control panel as Klarna pay now (via gateway), Klarna pay later (via gateway), or Klarna pay over time (via gateway) in the Payment Method field. Since Klarna pays merchants immediately for pay later and pay over time transactions, you can process Klarna orders as you would any typical order.

.png)

Connecting Klarna via Stripe? You can also offer Klarna Financing at checkout. This allows shoppers to make payments over a long period of time, usually involving interest and a credit check. See Stripe's Klarna payments documentation for more information.

Requirements and Limitations

- Your store must meet the following criteria:

- Your store must use Optimized One-Page Checkout.

- Shopper Requirements

- Shoppers must use a transaction currency that corresponds to their billing address. For example, if a shopper's billing address is in the United States, the transaction currency for the order must be USD.

Supported Gateways

Adyen

See Connecting with Adyen for documentation on features, requirements, and setup.

- Additional Setup

- You must have one of the following transactional currencies available: AUD, CHF, EUR, DKK, GBP, NOK, SEK, USD.

- You must request the payment method to be added to your Adyen account.

- Make sure that you comply with Klarna's scheme rules. If you don't follow scheme rules, Klarna has the right to charge back the payment.

- To offer Klarna in Switzerland, contact Adyen Support.

- Shopper Requirements

- Shoppers must use an address from one of the supported countries at checkout.

- Shopper’s transaction currency must be AUD, CHF, EUR, DKK, GBP, NOK, SEK, or USD.

- Limitations

- Not all supported country and currency combinations will have access to every Klarna payment option. See Adyen’s Klarna page for more information.

Mollie

See Connecting with Mollie for documentation on features, requirements, and setup.

- Additional Setup

- Your store must have EUR, GBP, NOK, DKK, or SEK as an available transactional currency corresponding to each payment method enabled.

- You must select whether transactions will be Authorize Only or "Authorize & Capture".

- Each Klarna payment method (One Klarna, Pay Now, Pay Later, and Slice It) must be individually enabled in your Mollie dashboard under Settings › Website Profiles.

- Shopper Requirements

- Each Klarna payment method has its own set of supported billing countries:

- One Klarna: UK

- Pay Now: AT, BE, DE, FI, SE, NL

- Pay Later: AT, BE, DE, DK, FI, FR, IT, NL, NO, PT, ES, SE

- Slice It: AT, DE, DK, FI, NL, NO, SE

- Shoppers must use the corresponding supported transactional currency for each payment method:

- One Klarna: GBP

- Pay Now: EUR, SEK

- Pay Later: EUR, SEK, DKK, NOK

- Slice It: EUR, SEK, DKK, NOK

- Each Klarna payment method has its own set of supported billing countries:

- Limitations

- Klarna Pay Now orders cannot be voided.

- Each Klarna payment method has country-specific order value limits. See the FAQ for more information.

Nexi XPay

See Connecting with Nexi XPay for documentation on features, requirements, and setup.

- Additional Setup

- You must register via the Sofort portal located in the Alternative Payments tab of your Nexi merchant account. Once you have registered, you must configure your Klarna profile with your project ID, customer number, and API key.

- Limitations

- Klarna orders cannot be voided.

- Refunds are not supported.

Stripe

See Connecting with Stripe for documentation on features, requirements, and setup.

- Additional Setup

- Your store must have USD as an available transactional currency.

- Your Stripe merchant account must be based in the United States.

- You must be on the latest version of Stripe to offer Klarna.

- Shopper Requirements

- Shopper’s billing address must be in the United States.

- Shopper’s transaction currency must be USD.

FAQ

What are the order value limits for Klarna via Mollie?

Klarna’s payment options with Mollie will only appear as available payment options if an order falls within the minimum and maximum order values determined by the shopper’s billing country. The minimum and maximum order amounts for each Klarna option can be found in Mollie’s support article.

Are recurring payments supported on Klarna?

While Klarna offers shoppers the ability to delay payment or pay in installments, it does not support recurring or subscription payments.

Can I perform a partial capture with Klarna via Mollie?

If you are not able to fulfill part of your order, you can edit the order and remove the line items prior to capturing the funds.

However, you cannot edit the price of a product or add new products to the order prior to capturing funds. Additionally, editing the product's SKU prior to capturing funds will cause the capture to fail. This is because Mollie requires individual line items to be sent when performing a partial capture, and the integration uses price and SKU to determine which line items to send.

Additional Resources

- Klarna (Adyen Docs)

- Add Klarna: Pay Now to my Website (Mollie)

- Klarna payments (Stripe Documentation)