Worldpay B2B Payments powers ecommerce and web-based payments – giving merchants streamlined and secure checkout and payment management. Our integration with Worldpay B2B allows merchants to accept electronic payments by supporting Visa, Mastercard, American Express, and Discover.

Requirements

To use Worldpay B2B Payments, your store must meet the following requirements:

- Your store must be using Optimized One-Page Checkout

- Manage Payments and Manage Settings user permissions must be enabled.

- You must use one of the following payment processors with Worldpay B2B Payments:

- Paymentech Salem

- Paymentech Tampa ISO

- Vantiv CNP

Setting up Worldpay B2B in BigCommerce

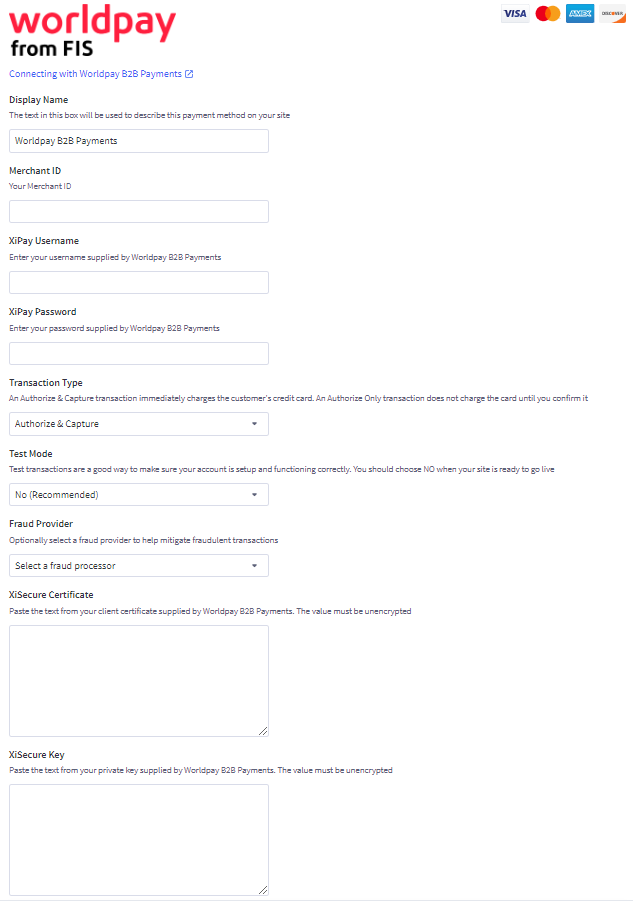

To set up Worldpay B2B Payments, go to Settings › Payments and select Worldpay B2B Payments from the list of Online Payment Methods.

If you do not have an existing Worldpay B2B account, contact them to create one. Once the account has been created, return to BigCommerce, set up a Display Name, enter your credentials and configure the additional settings.

- Display Name — control how the payment gateway appears at checkout. We recommend something like Credit/Debit

- Merchant ID — the Merchant ID that was supplied to you by Worldpay when you created your account

- XiPay username — the username that was supplied to you by Worldpay when you created your account

- XiPay password — the password that was supplied to you by Worldpay when you created your account

- Transaction Type — can be set to Authorize & Capture or Authorize Only. Authorize Only allows you to capture the funds manually. See Manually Capturing Transactions (Authorize Only) to learn more. This must also be properly configured on your Worldpay B2B account.

- Test Mode — determines whether your store is in Test Mode. Set to No (Recommended) when you are ready to take payments

- Payment Processor — check if you are using the Vantiv CNP processor.

- Note that if you are using Vantiv CNP, the integration only supports authorization. Capture, void, and refunds are not supported. Fraud Processors are also not supported by Vantiv CNP.

- Fraud Provider — determines the fraud service provider that will be used to screen your transactions for fraudulent behavior. This must also be properly configured in your Worldpay B2B account. Fraud screening can only be used with the Authorize-Only Transaction Type.

- Xi Secure Certificate — the text from your client certificate supplied by Worldpay. This certificate must be updated every two years.

- Xi Secure Key — the text from your private key supplied by Worldpay. The value must remain unencrypted.

Stored Credit Cards

Stored credit cards allow your shoppers to safely and securely store their credit card details to make future purchases faster and easier. The credit card details will be stored securely with Worldpay B2B Payments and associated with the billing address stored with the customer record on your store. See Enabling Stored Credit Cards to learn more.

Common Questions

Account Eligibility

What currencies and countries does Worldpay B2B Payments support?

The supported countries and currencies vary depending on the payment processor you set up through Worldpay B2B Payments. To view a list of the supported payment processors and their supported countries and currencies, visit Worldpay B2B or contact your Account Manager to review your particular payment processor.

By default, payments will be processed in the local currency that your business is registered in. For example, if you’re a United States business, then payment will default to USD.

What items are restricted for merchants to sell?

Restricted items will depend on your payment processor and limitations the payment processor may impose. Visit Worldpay B2B or contact your Account Manager for more info.

Transactions

How long until transaction funds are transferred to my bank?

This will depend on the merchant agreement you have with your payment processor.

Refunds

How soon after a transaction can I perform a refund?

This will depend on the merchant agreement you have with your payment processor. Some payment processors allow for blind/unreferenced credits in which case there is no window within which a refund must be performed.

Is there an amount of time after which I cannot perform a refund?

This will depend on the merchant agreement you have with your payment processor.

Are there any fees for chargebacks/refunds?

This will depend on the merchant agreement you have with your payment processor.

Additional Features

Are there any fraud filtering options available?

Yes, BigCommerce supports the Worldpay B2B fraud workflow, ‘Authorization then immediate Fraud call’ with each of the following fraud providers:

- Accertify

- CyberSource Decision Manager (Limited to merchants that have implemented CyberSource Decision manager ONLY, but are processing payments through a different processor other than CyberSource.)

Based on the fraud results returned on an order transaction from Worldpay B2B Payments, the Fraud Status on the order in BigCommerce will be set to either Declined, Approved or Review.

Does Worldpay B2B allow authorize-only or recurring/subscription payments?

- Authorizations: Yes. Authorize-Only, Authorize & Capture, Void, Full Refund, and Partial Refund are supported.

- Recurring/Subscriptions: Not supported at this time.

Troubleshooting and Payment Disputes

How are payment disputes handled?

This will depend on the merchant agreement you have with your payment processor. Your payment processor manages the funding and communication with your issuing bank. Work directly with your payment processor regarding any payment disputes.

How do I contact Worldpay B2B Support?

Use the technical support phone numbers listed below. You can also email WorldpayB2BSupport@fisglobal.com or visit the Service Portal which provides Knowledge articles and the ability to submit support tickets.

- US Toll Free — (888) 445-4901

- US Local — (713) 895-2003

- Europe — 44(0) 207-993-5154

- Asia Pacific — 8(134) 578-9522