Serve First is an award-winning and highly specialized payments company based in Orange County, California. With nearly two billion dollars in payments processed nationwide, Serve First continues to be a leader within the payments industry.

Serve First offers automatic Level II and III data collection and processing for eligible transactions, which lowers the cost to process credit cards. Unlike many payment processors, Serve First is passing these savings directly on to BigCommerce clients.

Credit card payments using Serve First are processed through the My SFS Gateway. This payment integration is especially suited to B2B merchants in the United States operating in wholesale, manufacturing, and distribution sectors.

Requirements

- Store must be based in the United States.

- Store must be transacting in USD.

- Manage Payments and Manage Settings user permissions must be enabled.

Setup

If you do not currently have a Serve First merchant account, reach out to Serve First's sales team to receive a personalized quote. When you are ready to proceed, Serve First will guide you through the application process.

Once your merchant account is approved, Serve First will provide you with merchant credentials. Use the steps below to connect your merchant account with your store.

1. Go to Settings › Payments and select Serve First from the list of Online Payment Methods.

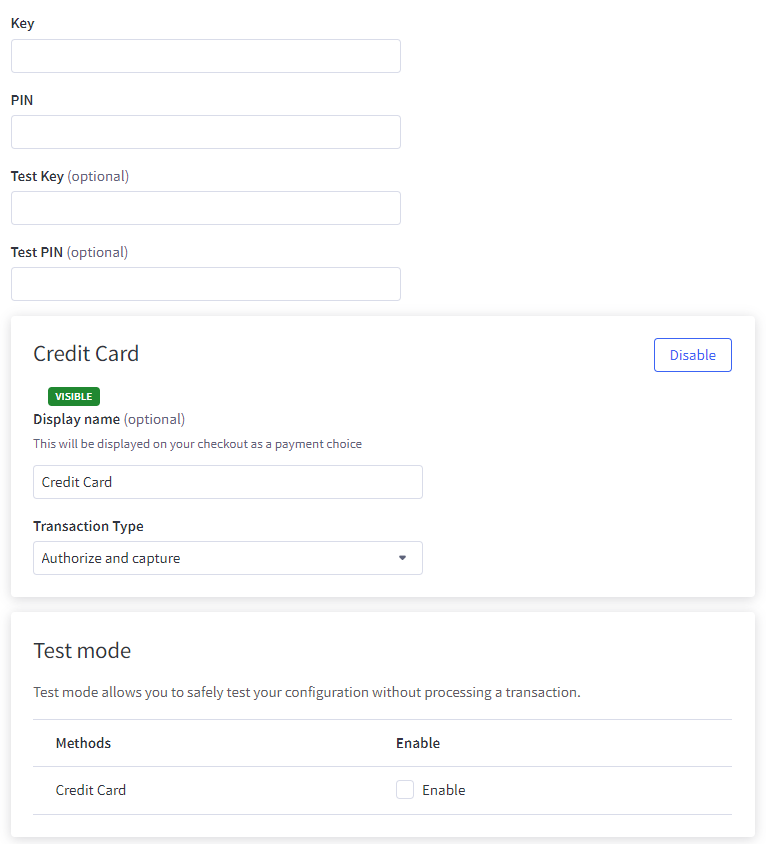

2. You will be taken to the Serve First Settings tab. Copy and paste the merchant credentials provided by Serve First into the Key and PIN fields.

- Key — the API key provided to you by Serve First.

- PIN — the PIN provided to you by Serve First.

- Test Key (optional) — the API key for the test environment, provided by Serve First. This field is required only when Test Mode is enabled.

- Test PIN (optional) — the PIN for the test environment, provided by Serve First. This field is required only when Test Mode is enabled.

- Credit Card — toggles credit card visibility on the checkout by clicking Enable/Disable.

- Display Name — controls how the payment method appears at checkout. We recommend something like Credit Card.

- Transaction Type — can be set to Authorize and Capture or Authorize Only. Authorize Only allows you to capture the funds manually. See Manually Capturing Transactions (Authorize Only) to learn more.

- Test Mode — determines whether your store is in Test Mode, which allows you to safely test your payment configuration without processing live transactions. Use the checkbox to toggle this setting.

3. When ready, Save your settings. Serve First will be live in your checkout.

Common Questions

- Pricing and fees

- Account eligibility

- Transactions

- Refunds

- Additional features

- Troubleshooting and payment disputes

Pricing and Fees

What fees are associated with Serve First?

Contact Serve First Solutions to receive a personalized quote.

Account Eligibility

What currencies and countries does Serve First support?

Serve First supports USD only, with no country requirements as long as the credit card has a Visa, Mastercard, Discover or American Express logo.

What items are restricted for merchants to sell?

While Serve First supports many verticals, some business types are prohibited. These include:

- hemp and CBD products

- electronic cigarettes

- virtual currency dealers

- counterfeit goods

If you are not sure if you are eligible for a merchant account, contact Serve First Solutions.

Transactions

After I create an account, what is the waiting period before I can process transactions?

Depending on account requirements, approval and activation usually takes 3-5 business days.

How long until the funds are transferred to my bank?

Once the transactions are batched out, funds will be deposited within 24-48 hours, depending on the time the batch out occurs.

Will I or my customers receive an additional email or invoice from Serve First?

Serve First allows for additional emails to be sent to customers. This setting can be edited from within the portal.

Refunds

How soon after a transaction can I perform a refund?

Refunds can be performed any time after the transaction is settled, typically the next business day. If the transaction is not settled, a void can still be performed to prevent the card from being charged.

Is there an amount of time after which I cannot perform a refund?

There is no time limit, unless the card has expired since the original sale.

Are there any fees for chargebacks/refunds?

Refunds are billed standard transaction fees. Chargeback fees are outlined in your merchant agreement.

Additional Features

Are there any fraud filtering options available?

Serve First has a number of fraud filters that can be enabled from within their online dashboard. Available filtering includes:

- AVS Filters

- CVV Filters

- IP Address

- Country

- Velocity

Does Serve First allow authorize-only or recurring/subscription payments?

Yes, Authorization-only transactions are supported.

Recurring payments and subscriptions are not supported at this time.

Does Serve First support multicurrency?

At this time, multicurrency is not supported.

Troubleshooting and Payment Disputes

Why did my shopper receive an error when trying to pay?

If the shopper receives an error, this is typically attributed to the card issuing bank. Please contact Serve First Solutions at (877) 737-7355 for assistance.

How are payment disputes handled?

A letter outlining the chargeback and instructions for submitting documentation to dispute is mailed out upon the filing of the chargeback. Upon request, an online portal can also be provided for managing disputes.

How do I contact Serve First’s Support?

You can contact Serve First by phone at (877) 737-7355, or reach out via email.