Credit card installments are an enhancement to Adyen card payments which allow shoppers in Brazil and Mexico to split their purchases into equal monthly payments. Installments are highly popular in this region — representing 80% of all ecommerce payments in Brazil — and can increase conversion and average order value by making it easier for shoppers to pay for big-ticket items.

Can I offer credit card installments with other payment gateways? See Recurring Billing for a complete list of payment gateways and alternative payment methods that support installment and “buy now, pay later” transactions.

How It Works

After configuring credit card installments with Adyen, shoppers meeting the requirements can choose one of the following options when selecting the credit card payment method at checkout:

- One time payment — The payment is treated as a standard credit card transaction for the full order amount.

- Installments payment — The payment is broken up into equal monthly payments based on the selected installment plan.

- Revolving payment — The shopper makes an initial partial payment, and the remaining balance is split into a number installments determined by their card issuer.

The shopper pays the first installment upon placing the order, and they are automatically charged every 30 days until the order is paid in full. Orders placed using credit card installments appear in your control panel as Adyen (Credit Card) and share the same fulfillment process as typical orders.

Do I receive payouts on a per-installment basis, or am I paid in full after the first installment? The payment schedule for credit card installments is determined by the currency used by the shopper. See the FAQ for more information.

Requirements and Limitations

- Your store must meet the following criteria:

- Your store must be using the latest version of Adyen.

- Your store must have BRL or MXN as an available transactional currency.

- In order to offer installments in MXN, you must process payments with local acquiring.

- Your store must use Optimized One-Page Checkout.

- Shopper Requirements

- Shoppers must use a shipping address in Brazil or Mexico at checkout.

- Shoppers must have BRL or MXN selected as their transaction currency.

- Shoppers must use a credit card from one of the following brands: Visa, Mastercard, JCB.

- Shoppers must get approval from their card issuer in order to make a revolving payment.

- Shoppers using MXN as their transaction currency must use a card from a supporting bank in order to pay in installments.

- Limitations

- Stored credit cards are not compatible with revolving and installment payments.

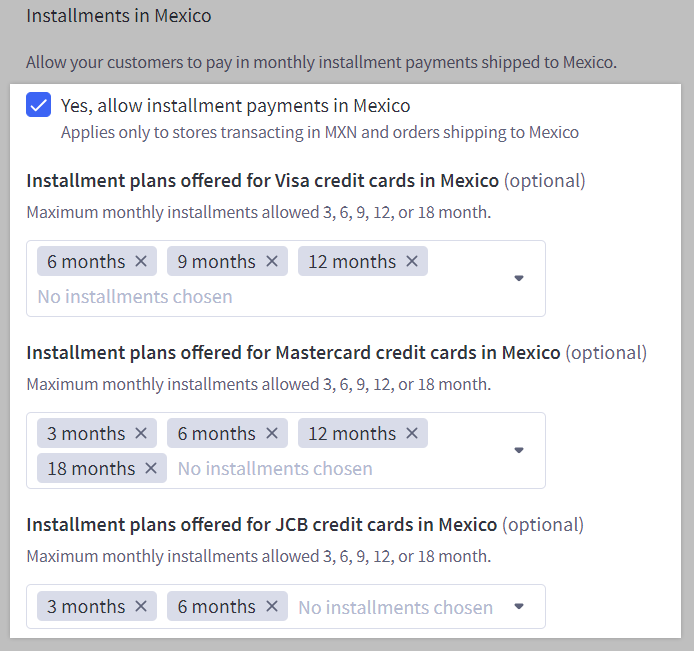

- You can enable a maximum of 5 installment plans per card brand.

- Credit card installments are not supported for orders consisting exclusively of digital products or gift certificates.

Setup

In order to offer installment payments at checkout, you must first submit a request for it in your Adyen customer area. Once Adyen has activated the payment method in your account, log in to your BigCommerce control panel. Navigate to Settings › Payments and select a supporting currency, then navigate to the Adyen Settings tab.

Scroll down to Installments and check the box to enable installment payments. From there, select the installment plans you wish to support for each card brand from its respective drop-down menu. To prevent shoppers from using installment payments with a certain card brand, do not select any installment plans for that brand.

Each available currency supports different installment plans:

- BRL — any number of monthly installments greater than or equal to one and less than 100

- MXN — 3, 6, 9, 12, or 18 monthly installments

FAQ

Can I use post-order actions with orders placed using credit card installments?

Yes, the following actions are supported:

- Manual capture

- Voiding authorize-only transactions

- Full and partial refunds

How do payouts work with installment and revolving purchases?

The payout schedule is determined by the currency used.

- If the shopper uses MXN as their transaction currency, you will receive the funds in full after the first installment is settled.

- For BRL, you will receive the funds for each installment as it is paid.

- If you are offering revolving and installment payments in BRL, and wish to receive the funds upfront, you can apply for advancements by contacting Adyen. See Installments and advancements in Brazil for more information.

Are there any fees associated with credit card installments?

You will be charged an additional fee for installment purchases in MXN. If you offer installments for BRL, there is only an additional fee if you apply for advancements. For details on these fees, contact Adyen Support.